How to Use AI For Tax Review Safely

By Jereme Peabody

Tax Problems

For three years straight, my wife and I owed Uncle Sam over $2,000 at tax time. Using AI for taxes helped me figure out why. I'm not a tax professional. We do our taxes using H&R block online. Our taxes are pretty straight forward, we have a house, a child in school (no daycare), no one is in college at the moment, everything should be standard right? We both claim 0 (maximum withholding) on our W-4s, so why do we still owe? I used ChatGPT to find out.

First Step: Redact Sensitive Information

Before using AI for tax preparation, you need to protect your personal information.

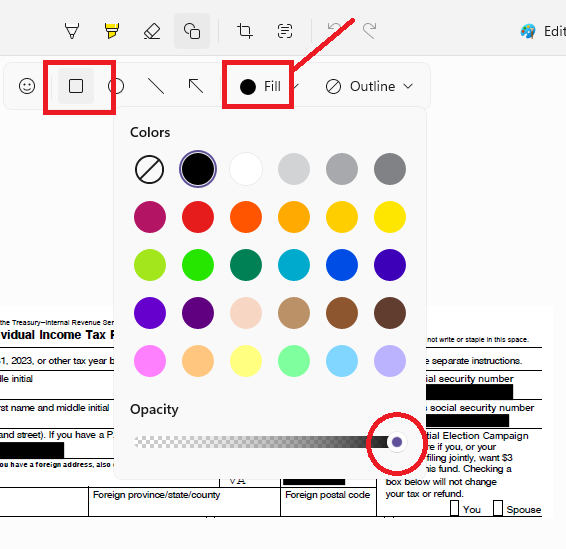

Most AI models allow you to upload images. It's something magical and this is my recommendation to you. Download a PDF of your tax return. Find your 1040 page and use your Snipping Tool to take a picture of it. I took 2 pictures because they span 2 pages. But on each page, use the snipping tools features to black out the sensitive information. Select the rectangle tool, and make sure the opacity on the Fill is all the way up and set to black.

This is how to use AI for taxes safely -never upload unredacted documents.. This image is NOT all-inclusive, you'll find private information everywhere. Redact it!

Second Step: Share your information with the AI

Upload your documents or CTRL-V into the chat. Both ChatGPT and Claude AI handle images well for tax review..

Double and triple check for information that should be redacted before you upload.

Here's the redacted 1040 can you review it for accuracy and what I might be missing? My wife and I claim 0 every year, but we're always having to pay federal taxes for some reason. My wife and I both work and we have 1 child.

Third Step: Review the result

AI does a surprisingly good job understanding tax codes. It showed me we were under-withholding by 1.3% and suggested adjusting our W-4 to bridge the gap. It accurately shown me how much we were off, what might be missing, and how to fix our withholding!

Using AI for tax preparation won't replace a CPA, but it can help you spot obvious problems safely.